Fintech's latest craze: Payroll APIs

Are Pinwheel and Payroll APIs revolutionary or will they end up in Plaid's product suite?

Hey everyone 👋 — I’m Avirath. I learn a lot from analysing new products, thinking about new product strategies and my opinion on the markets/products for the future. I wanted to share this knowledge with my readers - that’s the motive behind this newsletter.

This article covers a breakdown of Pinwheel, the opportunities it has on its hands and the challenges it faces in scaling. I, initially, did not want to publish this because I’ve consciously used this piece to understand flaws in my writing style and feel I can do a much better job. However, M.S. Dhoni’s story reminded me that you have to celebrate your weak points so here goes.

Grateful to Erik Torenberg for motivating me and Aarush for helping edit it.

Join the fun on Twitter.

Actionable insights

If you only have a few minutes to spare, here’s what you should know about Pinwheel.

Focus on connecting to payroll systems. Payroll systems hold a lot of important data but are very difficult to connect to. Till the late 2010s, people had to print out or mail W-2 payroll stubs or fill in several forms to provide banks, fintech applications access to their wage data. Pinwheel provides APIs to connect to over 1600+ payroll systems to provide fintech applications access to wage data and identity of employees in a secure manner. This reduces an exhausting process to a simple line of code.

Strong Founding Team. Pinwheel was founded by Curtis Lee and Kurtis Lin who worked on building real-time valet parking startup Luxe and have experience at companies like Groupon, Opendoor and Zynga.

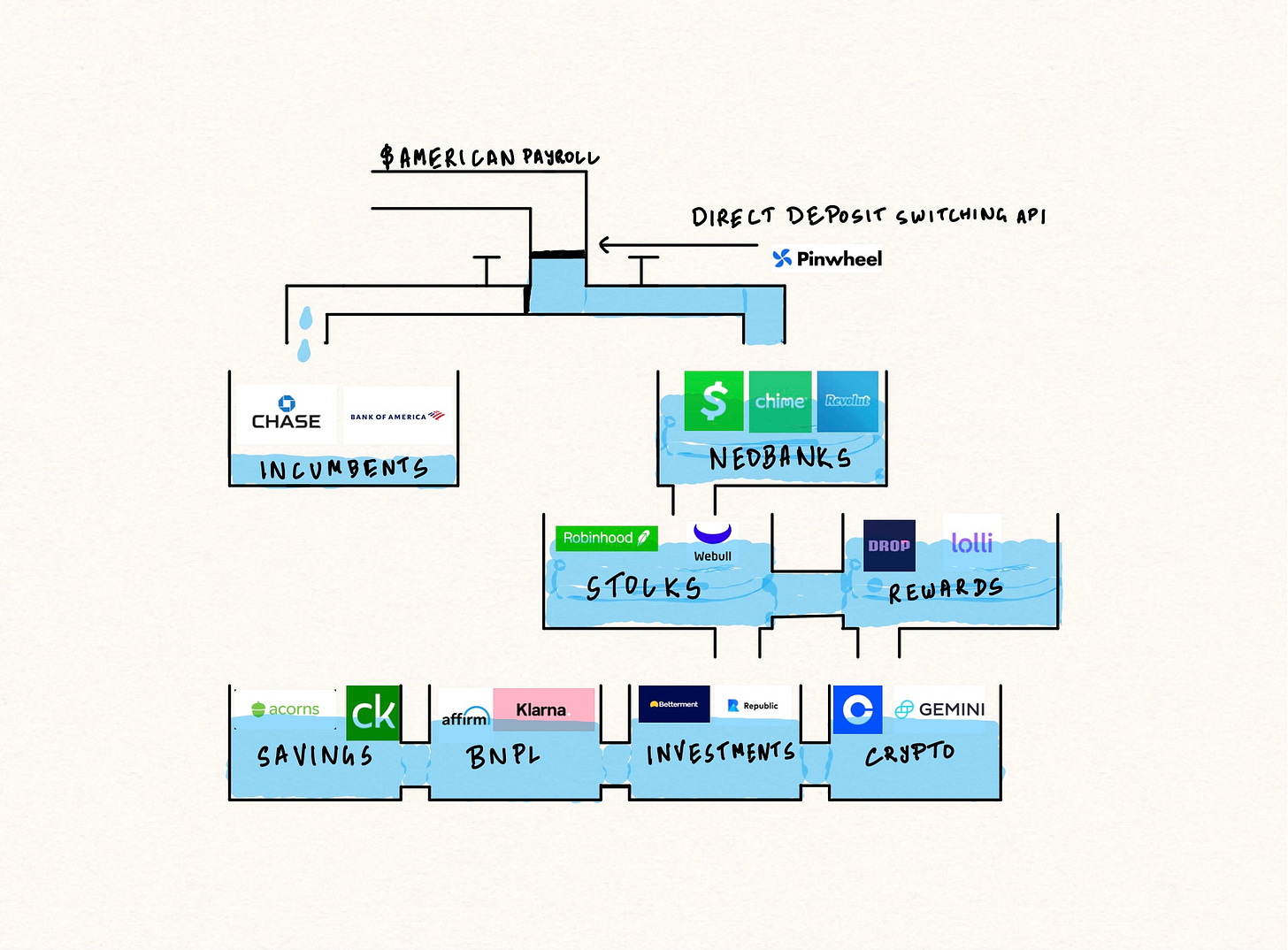

Several Financial Applications. Historically underserved communities with low FICO scores can now be provided credit and unsecured loan products on basis of their wage data that can be reviewed weekly, monthly and yearly. It helps employee benefit startups like Carta provide customised offerings to companies and employees. Employees can also switch their direct deposit from incumbents(like Chase) to modern neobanks(like Chime and CashApp) that offer better customer experience and better value props.

No Apparent Flywheel. Though Pinwheel is working on an essential part of the fintech stack, there seems to be a lack of applications/APIs with a recurring use case. Pinwheel should sign exclusive partnerships or use its data to build its own credit products.

“There is not a line in the Wealth of Nations that is still not applicable today.” - Milton Friedman, Winner of 1976 Nobel Prize in Economics

Speak to any student, researcher, politician, or economist, and they’ll point to Adam Smith as the Messiah of modern-day wealth creation and the Wealth of Nations as their Bible. The Wealth of Nations is a book containing Adam Smith’s observations from the first 17 years of the Industrial Revolution in Europe; specifically, on how nations would prosper economically with a focus on labor and free markets.

As one delves into ‘The Wealth of Nations,’ they uncover a fundamental message that underpins modern industries: increases in labor productivity and proficiency are direct results of dividing labor.

As an example, Smith posits that a pin-maker—without complete knowledge of how to make pins, or the pin-making industry—would not make more than one pin per day. He further claims that an assembly line of laborers with expertise in distinct facets of pin-making—drawing, straightening, cutting, honing, so on—would propel production with unparalleled efficiency. In short, reducing every man’s business to one simple operation increases the production output.

Adam’s observations from the beginning of the Industrial Revolution are astute and have stood the test of time.

Directly or indirectly adherent to the concept of labor division, Pinwheel founders Curtis Lee, Anish Basu, and Kurt Lin found an operation so nimble, yet so important, they could isolate, take on and power thousands of fintech platforms. ‘What is that operation?’ you may ask.

Let’s go back in time to the mid-2000s. You want a credit card, so you go to your local brick-and-mortar bank. The manager you’re meeting makes you fill a form taking in your personal details, employment records, owned assets; and to prove your creditworthiness, you’re forced to submit a heap of past payroll papers and ID cards(passport/driving license/social security card). A few weeks later, you’re either forced to make another trip to get your card or have it mailed.

Fast-forward to 2019: neobanks like Chime and Monzo manage your bank accounts. To get a credit card, you’re only a couple of clicks away from initiating a credit check process, where a decision engine powered by Alloy determines whether you receive a credit account. If approved, your card is added to Apple Pay and you’re good to go. However, not much has changed with respect to sharing payroll data apart from switching the medium of sharing over to e-mail. You still have to download months of W-2 payroll data for most unsecured loan approvals or to switch direct deposit banks. Pinwheel’s focus is bridging this wide chasm in the fintech system by allowing financial service apps like credit apps or neobanks(like Chime) connect to end- users’ payroll records by means of an API.

Although not the end product like a literal 'pin,' Pinwheel functions as a crucial facilitator within the expansive realm of fintech just like Adam Smith’s dexterous labourer.

Origins

There is a raw sense of romanticism and diligence that surrounds the most successful founders—especially in that they’ve been gritty business-mavericks since childhood, and have had multiple ventures. Jobs and Wozniak tinkered with illegal blue-boxes that could place long distance phone calls for free before the idea of Apple even came to their minds. Eventual Brex co-founders Henrique Dubugras and Pedro Franceschi created an online payment processor (Pagar.me) while still in high school. Pinwheel’s Kurtis Lin’s story began at a smaller scale with a prized possession of the 90s. Curtis Lee’s began with parking cars.

Each generation of kids has their own prized possession they liked to collect. It’s probably NFTs this decade, video-game discs for Uncharted and FIFA in the 2010s, Hotwheels and Barbies in the decade before and surely Pokemon cards in the 1990s. Collecting and re-selling cards was a major fad in those days and the ultimate treasure among them was the holographic Charizard card. Like a true 90s kid, Kurtis Lin was a huge fan of sourcing and buying packs of cards. He, however, had traditional Asian parents who were not going to spend money to buy him these cards. This prompted Lin to forgo lunch at school, opting instead to immerse himself in a continuous cycle of trading lunch for more valuable Pokemons. A few hungry stomachs later, he ended up with a Charizard card. This hunger was a quality that would remain pretty instinctive much later in life when he took on building Pinwheel.

A few years later but with a similar hunger, Curtis Lee was solving a problem central most metropols face today. In modern cities, parking structures sit closely alongside buildings and attractions, almost as if urban projects would be incomplete without them. Yet, with a significant influx of people into cities worldwide, it's estimated that 90% of the population will reside in urban areas in the next 5–10 years. As cities become more densely populated, available land becomes scarcer and expensive. This makes it harder to justify using valuable space for parking, which is only used sporadically. As a result, parking lots are gradually giving way to housing and commercial buildings, reflecting a shift in urban priorities. After leading products at Groupon and Zynga for a few years, Curtis Lee decided to take on this apparent issue. This birthed Luxe, which offered on-demand valet parking services through a mobile app to make urban parking more convenient. Luxe achieved profitability in multiple cities, achieved an annual run-rate (ARR) of $20M and was ultimately acquired by Volvo. During his time at Luxe, Curtis Lee hired Kurtis Lin as GM, sparking a relationship that would eventually lead to them co-founding Pinwheel.

After selling Luxe, the pair found themselves at Opendoor, where they were introduced to health savings accounts (HSAs). A Health Savings Account (HSA) is a type of personal savings account you can set up to pay certain health care costs. An HSA allows you to put money away and withdraw it tax free, as long as you use it for qualified medical expenses. Similar to many tax-related offerings managed by big financial providers, the consumer journey with HSAs was far from seamless. The usage of these tax-advantaged accounts was disappointingly low, primarily because they needed to be pre-funded— and most users lacked the cash flow to do this. It was during this period that Lin and Lee encountered their initial inspiration: automating HSA savings. Their initial product searched for qualifying medical expenses in the user’s bank account, then deposited a proportionate amount into their HSA directly from their payroll.

While developing this product, the pair came to a significant realization: a substantial amount of time was spent in constructing integrations with various individual payroll systems, diverting their focus from the core product. This struck a lightbulb. In a previous piece (“Empower. Don't Just Create.”), I discussed how Shopify's role as an enabler has facilitated the growth of numerous enterprises that build websites on its platform. Similarly, Lin and Lee recognized the potential in crafting an API infrastructure platform to seamlessly connect to diverse payroll systems and letting thousands of companies facing similar connectivity issues build with real time access to payroll data. As a result, the duo swiftly pivoted from automating HSA savings to developing employment and income data/verification systems.

Products

Today, Pinwheel boasts a very different product than what it started with. The company has successfully undergone the journey from a single point API solution to a varied product suite: they now offer a broad coverage of APIs to build payroll-backed fintech products.They’ve built this with the consumer as the focal point. Their products seem to have a commonality of removing any friction, and their debut service of direct deposit-switching supports this thesis.

The following services are the pillars of their API suite:

At its core Pinwheel Direct Deposit Switch makes it easier for companies to provide end-users the customisability to switch the banks in which they receive their primary wage deposit. The current switching process is super high-friction, usually requiring employees to fill out a paper authorization form or navigate a clunky employee portal. Pinwheel seamlessly connects bank account destinations with payroll accounts to ensure you can switch to any financial provider in seconds. Users can spread deposits into several accounts as a fraction or send the whole amount into one account.

Pinwheel Verify and Pinwheel Earnings Stream are two of their other key services that provides essential data into identity verification and income with a simple API call. Knowing someone's income is a key factor in a number of important financial decisions, including mortgage and auto loans. The conventional route to verifying personal information and employment/income records demands either submission of data using W-2 stubs or identity forms or procurement of employment data from stagnant aggregators such as Equifax or Experian. The redundancy is inherent in repetitively verifying personal details using identity cards each time a financial provider or app is added by an end user like Cash App or Chime. Compared to outdated technological solutions or manual review, Pinwheel’s offering moves at lightspeed, with income verification occurring in an average of 90 seconds. Conversely data aggregated by companies like Experian or Equifax is stale since its acquired for a certain value at a specific point in time and then sold. In some cases, data being stale proves to be a big problem.

In an interview, Kurtis Lin highlighted how Fannie Mae encountered significant challenges due to the dependence on static data, especially during the pandemic.

“Hey, we have to shut down our verification solutions, which includes Equifax, because the information we're getting is not helpful.” Meaning, I'm getting information from Equifax saying, ‘Oh, Walter is currently employed at Animalz.” Well, that information is a year and a half old.”

One of Pinwheel’s distinctions compared to competitors also lies in the fact that they are FCRA compliant, allowing them to function as a consumer reporting agency. Rather than aggregating and dumping data in the laps of the businesses they sell to, this allows them to modulate, organise and structure data in a way that it is usable and insightful.

To expand themselves to be a stronger in payroll productivity, Pinwheel recently added a very useful feature called Pinwheel Taxes that lets tax accounting softwares retrieve tax-filing documents such as W-2s or 1099-Ks without end users having to manually upload them when filling out taxes.

Philosophy

Among tech’s collection of coffee-book quotes, Netscape CEO Jim Barksdale once said “Only two ways to make money in business: one is bundle; the other is unbundle.” Pinwheel is unique in its relationship to the quote as it acts as both a bundler and an unbundler. By connecting to over 1600+ payroll providers, it bundles key verification and income solutions under one roof through its APIs. However, by providing such a variety of solutions for easy tax filing, credit underwriting or easy routing of wages, it makes itself available to a wide array of modern fintech startups.

This dual role aligns seamlessly with Pinwheel's fundamental tenets of modularity and empowerment. The advantage with building a variety of integrations down to the root level with numerous payroll providers is that all of this data can now be wielded in whatever way businesses. This allows abstracting these connections for the several use cases we listed above and gives them the flexibility to build for many more. This would necessitate minimal technical investment, given that the foundational technical aspects in place. Since they focus on one category and amortize their development costs over thousands or millions of customers, they’re able to build for all of the little edge cases that add up to big advantages. I see a resemblance to what Packy discusses in 'Attention is All You Need,' where he explores how ChatGPT’s plugins transform OpenAI into a platform and aggregator, assimilating data and functionality from companies like Doordash or Instacart, thereby enhancing ChatGPT’s capability to utilize aggregated data to provide for several use cases to its users. Pinwheel ingests data from payroll providers, makes it usable and transfers additional capabilities and efficiency to its business partners.

The above transferring of capabilities and efficiency makes it an enabler as we’ll cover in the next section.

Key Opportunities

In 2014, Benchmark Capital legend Bill Gurley wrote a now very popular post. In "How to Miss by a Mile," Gurley contended that Aswath Damodaran, a professor at New York University, had missed critical qualitative parameters in his skepticism regarding Uber's $17 billion valuation. Using the worldwide taxi and limousine business as a benchmark, Damodaran neglected to take into account how Uber would expand the market overall thanks to a vastly improved experience, network effects, and a beneficial economic structure. The crux of Bill Gurley's argument lay in Uber's capacity to substantively enlarge the market through its intrinsic benefits and features.

Empowering Fintech platforms

Pinwheel serves as a comparable market expander, and this constitutes its most significant opportunity. Even though neobanks seem to radically improve customer experience and provide features like competitive yield rates, credit building options, and early paycheck access, only 4% of American customers had their direct deposits in a neobank, a side account for deals and freebies while maintaining primary accounts with incumbent banks. With direct deposit switching, Pinwheel has reduced clunky paper submissions to a 90 second process. Being a primary direct deposit bank handler singlehandedly increases the lifetime value of a customer by about 30-40x as banks inherently benefit from interchange fees, cross-sell opportunities and promote credit products with insights gained into their earnings. $10 trillion gets dissipated in bankroll every year. Even if Pinwheel partners with neobanks or competitive banks to switch 50% of the market, it’s a huge addressable market.

In its Q4 2021 earnings call, Block mentioned using Pinwheel’s API to grow Cash App’s direct deposit users to 1.5M, who bring in 6.5 times more cash inflows than its P2P users

However, another part of switching customers apart from friction, is intent. Neobanks and new-age fintech apps have to make it captivating for customers to switch. This is where compelling value props like earned wage access/early paycheck access or equitable credit lending products come into play.

Historically, founders subscribed to the belief that consumers within the low-income and low FICO (credit scoring method) brackets—or those bereft of a credit file—posed limited potential to build products. The focus gravitated towards accumulating high-income earners, amassing assets under management, and steering them towards high-margin services. However, Pinwheel can unlock a complete new monetisation model.

Instead of exclusively catering to high-income individuals, utilizing payroll data as an entry point for real-time insights into an individual's employment history and earnings over previous months or years enables new fintech products to serve historically underserved economic communities. This allows an organisation like Block(Cash App) or even a completely new startup make directed credit products or a company like Clair issue earned wage each day with high trust and verifiability

Furthermore, this avenue unlocks the prospect for merchants to delve into tailored customized offerings. Armed with a comprehensive understanding of an end-user's earnings, they can proffer a diverse spectrum of credit alternatives or "Buy Now, Pay Later" schemes.

Reliability

A significant issue with using static data reporting agencies like Equifax is their heavy focus on catering exclusively to major players, covering approximately 60% of the market, leaving the remainder of the market underserved. In fact, Kurtis Lin also shared that the ping rate for Equifax is only 20% where he said “In fact, talk to most lenders, the hit rate for Equifax is like 20%, give or take. So, you just have this huge coverage gap. You're like, “Well, what about everyone else? This is no good if it’s only working one out of five times.” That translates to these data aggregation companies having reliable credit or employment data only 1 out of 5 times. Pinwheel, with nearly 98% coverage, addresses all of these issues.

Building Integrations

Pinwheel can look at expanding services to improve offerings to not only customer facing B2B fintech apps but also payroll leveraging employee benefit systems. I spoke to a few intern friends who mentioned that several enterprise focused fintech companies(think of Carta or Bill.com) scrape data to use employee payroll data to build employee investment or payroll management applications. With scraping methods being unreliable, Pinwheel could expand by building specific integrations for use cases that these businesses may have. Think of Zapier x Pinwheel but for B2B fintech integrations like the following:

Retirement savings where companies like Human Interest use Plaid and Pinwheel to adjust the amount of money that goes into retirement savings based on wages earned and money spent in previous months.

Employee wage investing companies like Carta can take in parameters such as investor risk, expected return % and using payroll data, make investments to reach as close to the expected ROI.

This would just require better data processing on Pinwheel’s side but would open up nearly a $200 billion market.One of my writing idols, Packy McCormick, mentions in APIs All the Way Down “Strong API-first businesses sit in this sweet spot: they provide mission critical but non-core functionality to their customers, like accepting payments, providing cloud security, or sending communications to customers.” This seems to have worked wonders for the first generation of API companies like Plaid where B2B companies using Plaid could have built the functionality in-house but choose to outsource it to an API for a simple plug and work experience. The new age API companies like Pinwheel must make strong moats for themselves by providing a value addition whether this is by building custom integrations or simply making data more end-user friendly.

Though the market is ripe for Pinwheel’s taking, there are challenges that it’ll face - ones that can be defining for what the future holds.

Risks

Charles Darwin, in his famous Theory of Evolution, wrote “It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” The same could be said of companies. History has shown us that the smartest companies keep evolving to provide better value in terms of product, service or value add. Pinwheel must do the same.

Competition

One of the key observations of Plaid heralding the account verification API and also the first wave of embedded finance was that no other company could mount a challenge to Plaid’s dominance. Plaid’s execution to develop partnerships with bank or scrape data to automate verification faster than anyone else gave them a significant first mover advantage and it stuck. An important point to be understood is building on top of APIs entrenches them so deeply to the core of the business that it becomes exponentially more difficult and expensive to switch to a competitor with time.

Pinwheel’s biggest competitors include Argyle, Atomic and Plaid.

Argyle recently raised a $55 million Series B to develop their payroll verification further. They, too, have a rapidly growing coverage including over 500,000 U.S. employers, 60% of the Fortune 500, close to 100% of gig workers, and 170+ million U.S. employees.

In 2021, Atomic raised a $21 Series A to power their payroll APIs and are working with Coinbase as one of their biggest partners.

Plaid raised a $425 million Series D funding round in April 2021 at $13.4 billion valuation. Pinwheel’s biggest threat comes from Plaid as they stand as one of the most established embedded finance APIs with heavy brand loyalty. Plaid would also enjoy a huge existing customer base and extremely low customer acquisition costs due to easy cross-selling opportunities from their already extensive suite of APIs.

Pinwheel undoubtedly faces a threat from the companies above who are strengthening their payroll APIs and expanding across various fintech sectors. In particular, product additions that encroach on Pinwheel’s core offering put the company in a position where it must compete for the same clients, which results in higher advertising costs, possibly lower sales conversion rates, and pressure to lower prices.

Once an API company establishes itself, it can be hard to compete with as we’ve seen with Twilio in messaging, Plaid in account verification, Algolia in search and several other cases. It is quintessential for Pinwheel to be the best and take the lion’s share of the market.

As it moves upmarket, Pinwheel must be careful not to overcomplicate its product or market itself too heavily to big companies. It must keenly understand that startups are the essential lifeblood of the business, and only by engaging and overserving them can it retain their business.

Non-Recurring Use Case/Lack of a Flywheel

Pinwheel’s flagship product is their Direct Deposit Switching API. While it’s definitely an interesting way to get a foot into the door, the hard fact is that it’s not a recurring use case or something around which you can enjoy network effects. A customer could easily move from one switching provider to another; the utility is one-off on a per-customer basis.

The most successful fintech businesses have a flywheel around them. To take Plaid’s example, they started off by verifying if bank accounts existed, then spread to gathering transaction data and providing this to fintech apps that built catered products around these transactions. As more fintech companies started using Plaid, they started requesting more features such as fraud protection and payroll connectivity. Plaid spread into other parts of the fintech stack getting into transferring payments, forming committees where members share fraud data and increasing its existing coverage. All of this enables to continuously improve their data reserves on all stakeholders - B2B customers, end-users, fraudsters and even competitors. Using this, Plaid can execute in marketing, strategy, partnerships and new products with guns blazing.

Pinwheel seems abstracted from such a flywheel now. They should build on the income data they receive to start a lending arm or analyse the most profitable businesses that use payroll data. Then, build those structures themselves. The data they receive, along with their position as a credit reporting agency, should be used to get into lending products where they can earn on interest and other fees.

Like old is black gold, data is binary gold. Pinwheel can find itself at the helm of using such data to create financial products especially for the lower to middle class sectors of economic society.

Future

In the past few years, the most impressive fintech API companies(Stripe and Plaid particularly) have become complete suites with payments, fraud protection, identity and payroll verification all under one wide umbrella.

Sticking to a cog(payroll APIs) in the machine can prove to be counter-intuitive as bigger behemoths start integrating this into their suite of products and winning with network effects.

Simply, expanding the suite of APIs to include what Stripe or Plaid already do really well would just place them in a boxing match with no guard. The other two have insane distribution and network effects already. The best way forward could be either one of two things: expanding into other niches or new age services such as secure payments with the FedNow or RealTime Payments network to propel instant transfers compared to the current slow ACH system. Secondly, Pinwheel can stick to payroll APIs but plan geographical expansion much faster than it has. Countries in Europe and Asia house a great amount of labour but face similar problems in connecting to payroll.

Pinwheel has defined an important problem in the fintech space but only time will tell if they can ward off the behemoths and expand as quickly as they need to.

If you have any feedback or suggestion, do loop it in the comments section. I’ll be sure to take a look at it and even reach out to discuss if possible. You can reach me at avirathtibrewala@gmail.com for any other queries or discussions.

As a part of my newsletter, I wanted to affect some moral good to the society we live in. Every time I publish a post, I’ve decided to share an artefact or excerpt on kindness and benevolence.

This week, listen to this impassioned speech from Joaquin Phoenix from his Oscar winning night and here’s the short version if you’re busy.