Hey everyone 👋 — I’m Avirath. I learn a lot from reading S1 teardowns, company analysis reviews, IPO previews. I wanted to share this knowledge with my readers - that’s the motive behind this newsletter.

This article covers a close analysis of Shopify and their model of business. Shopify has a unique strategy of empowering partner brand’s businesses rather than centralising products from them. This has led to their share price raising by more than 200% over the past couple of years. What powered such growth? Find out below.

If you are interested in receiving future content from me directly in your inbox, consider subscribing 👇.

Join the fun on Twitter.

Red Bull was established in 1987. It’s global revenue amounted to $7.4 billion in 2020. The Economist released its first issue in September 1843. The Economist Group’s revenues in the last six months upto March 2021 were stated at $310 million. Heinz’s net sales in 2020 were pegged at $26.8 million dollars. Shopify currently powers all of the above mentioned brands’ online sales platforms. Suta, an Indian handicraft and artisan brand, sells dresses, blouses and sarees. Point to be noted - Shopify doesn't sell energy drinks or newsletters or tomato ketchups but it still powers their backend e-commerce storefront.

The Web can be divided into two(or three now) stages.

The Web 1.0 referred to the read only generation of the web where creators could post information and consumers could read and use this information.

The advent of Web 2.0 called for more dynamic pages to be created where creators and consumers could manipulate information according to will and share such content on multiple platforms. This age of the Web also increased interaction between consumers and creators through social networking sites like Facebook, Twitter and WhatsApp. Further, it cemented the relationship between consumers and creators by monetising this relationship in the form of e-commerce.

The latest development in the Web with Web 3.0 has called for a more decentralised, distributed and intelligent aspect of the Web coming about with technologies like blockchain and artificial intelligence growing in strength. In respect to Shopify, this means creators having more control over their own stores rather than being consolidated into a single platform like Amazon.

In the broader aspect or in the eyes of Shopify, brands like Heinz and Red Bull or small time fashion artists like Suta are creators and Shopify is a player in the background providing them the tools to create their own identity without overpowering their own brand identity. According to this article on Stratechery, 218 million people have brought products from Shopify powered brands without knowing Shopify existed. Shopify has perfectly placed its position with Web 2.0 and 3.0. With their ability to monetise their relationship by providing marketplace like services, it has all the personalities of the second generation of the web. By being decentralised in helping brands promote their own value, Shopify also has a hint of Web 3.0. Here’s where the narrative between Amazon and Shopify is different.

Back in 2019, Tobi Lutke(CEO of Shopify) stated that he aimed to “arm rebels” to create and sustain individually empowered e-commerce businesses. If recent trends are to be followed, NFTs and social crypto tokens have been gaining traction to give creators more value of what they create. Shopify allows brands, individuals and teams to retain their value and does not take a share of their sales(directly at least).

How Shopify does it?

Primary Revenue Earners

Shopify’s primary service is to allow brands to create an e-commerce establishment for themselves. Shopify provides services of easy website creation, domain registration and hosting. Shopify sells these services through different subscription plans according to the scale and level the business is at. Though Shopify’s most basic plan starts at $29 and extends to around $299. Recently, Shopify released a “Lite” version of their product that allows anyone to add products/sellable items to their existing website or blog and accept credit card payments for just $9 per month. This just expands the idea that Shopify wants to become the primary enabler for all e-commerce from a teenage made jewellery store to a big brand like Red Bull.

Shopify has also expanded itself to physical stores. Retail and physical network presence will not die out and Shopify has worked to gain from both online and physical presence. By creating a POS system, they’ve created a unified dashboard to accept and manage payments, inventory and also quicken the process of creating an omni-channel distribution network. Some of the tools that merchants have access to via their store dashboard are analytics, data, inventory, orders, payments, and many other tools you can think of.

Mini Ecosystem

Shopify works in a smart way to provide their users with various kinds of plugins. By just creating an App Store on the Shopify platform, they’ve directly connected developers and business owners. It’s similar to the move Roblox pulled off with their metaverse ecosystem where it connects game developers and players on the Roblox network. In May 2020, Shopify announced that there were about 4200 apps on its App Store and that about 87% of their merchants use apps from the App Store with an average of 6 apps being installed. The App Store is another example of how Shopify creates tools to directly help brands that work with them.

Shopify recently began working on their Fulfilment Network tool. Using Machine Learning and data processing, Shopify is creating a fulfilment network to manage the packing, storage and shipping of Shopify’s partner stores’ goods. The use of AI and ML comes with the promise of one to two day shipping which is where Shopify poses a threat to Amazon. Amazon’s wide fulfilment centre network has grown to be unbeatable till now. Shopify plans to use data to connect stores with the best positioned fulfilment centres to quicken the process of fulfilment.

As a whole, Shopify is rapidly scaling the methods by which they can horizontally integrate all aspects of their partners’ businesses. From backend inventory management to last mile fulfilment, Shopify has found ways to increase the dependency of partner brands on them while increasing their number of partners.

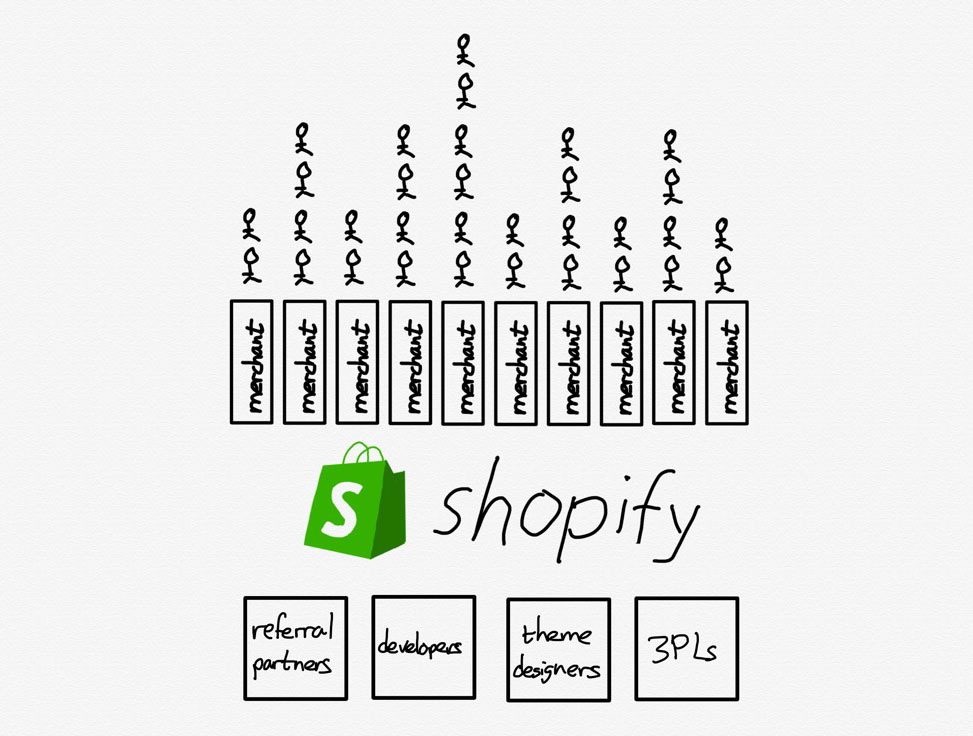

What is also powerful about this model is that it leverages the best parts of modularity — diversity and competition at different parts of the value chain — and aligns the incentives of all of them. Every referral partner, developer, theme designer, and now 3PL provider is simultaneously incentivised to compete with each other narrowly and ensure that Shopify succeeds broadly, because that means the pie is bigger for everyone.

In comparison, Amazon’s model can sometimes stunt the growth of certain suppliers over others. Popular sellers tend to be rated better and show up more often in recommendations. This leads to a certain disproportionate relation being created among stakeholders. Shopify, on the other hand, creates an equitable relation with all stakeholders involved.

Shopify’s Continued Momentum

Shopify reaped the benefits of the pandemic but hasn't stopped growing. Total revenue in Q1 2021 amounted to $988.6 million, with growth accelerating to 110% YoY(year on year). At the end of 2020, Shopify had 1,749,000 merchants from more than 175 countries with a great diversity range among continents. While North America accounted for 56% market share rate, Asia accounted for 15% of the market share and Europe and the Middle East amounted to 23%. Shopify’s revenue growth gradient can also be extrapolated from the graphic. The last three years have amounted to almost the same revenue as from 2006 to 2017 which just gives enough encouragement for the years to come.

In 2020, Shopify’s merchant stores averaged 386 million monthly average users and they processed about 121.1 million orders every month. None of Shopify’s merchants account for more than 5% of their total revenues in a single reporting period. A Reuters report from February stated that only 33 sellers in India accounted for a third of Amazon’s revenues in the country. It just goes to show how diverse Shopify’s customers are without dependence on a certain merchant.

The “Young” Promise with Shopify

Shopify’s model also presents entrepreneurs with a very enticing opportunity to entirely bootstrap their backend while focusing on the more important aspects of entrepreneurship such as scaling, customer growth and product growth. Shopify, in 2020, increased its free trial from 14 to 90 days. According to their Q1 2020 report, new stores on the Shopify platform grew by 62% between March 13, 2020 and April 24, 2020 compared to the prior six weeks. The large majority of Shopify’s merchants are on subscription plans that cost less than $50 per month, which is in line with our focus on providing cost-effective solutions for early stage businesses. According to their 2020 annual report, Shopify directs more than 90% of of their marketing efforts towards SMBs and entrepreneurs.

Shopify’s initiative to grow its partnership with first time founders and businesses has also taken another form of birth in Shopify Capital. With Shopify Capital, merchants and businesses can take small to medium loans from Shopify at comparable interest rates. With this Shopify not only wins from their loan interest returns but also that they become lifetime partners with such businesses. It’s in the best interest of both Shopify and the partner to perform well to increase their returns.

Wise or SolidFi is an example of an entrepreneurial initiative that sprung out of Shopify. They started out as a digital bank for e-commerce stores on Shopify and have not expanded to other platforms. The company is quite effective and quickly grew from 0 to 1000 B2B customers. Since then, the company has expanded into diverse banking service while growing partnerships with companies like Etsy.

Valuation and Future?

Through the pandemic, Shopify’s stock has risen to around $1500 with a market cap of $180 billion dollars. There’s been a monumental increase in the stock price but the true essence of Shopify’s future lies in the fact that if they can capture the market Amazon currently rules over.

In 2020, Amazon captured a 37% share of the e-commerce market. Shopify is still a long way away but they’ve only recently started benefitting from their early principle of empowering “shops” rather than aggregating their products. While Jeff Bezos’ baby is trying to centralize all e-commerce activity, Shopify’s goal is to give any merchant a chance to compete. According to an edition of the Hustle, Shopify now captures a 10% market share which goes to show how much value they’ve added in the past year alone. A lot of their initiatives have only sprung recently which means there is scope for heavy value addition to come in the following years. Projects like Fulfilment Network, Shopify Capital and even Shopify Audiences are to provide integrated value to merchants which in turn means increased value growth for Shopify itself.

Final Thoughts

Personally, I resonate with Shopify’s vision to provide a platform rather than “be” a platform. The benefits of such a thought process have been seen with Slack, Airbnb, AWS(specifically). Rather than creating the end product, these services let you depend on them to create great things. Shopify has invested in this ideology and invested well. The more other products depend on you, the greater it increases the chance of succeeding in the end. That’s why - Empower. Don’t Just Create.

If you have any feedback or suggestion, do loop it in the comments section. I’ll be sure to take a look at it and even reach out to discuss if possible. You can reach me at avirathtibrewala@gmail.com for any other queries or discussions.