Hey everyone 👋 — I’m Avirath. I learn a lot from analysing new products, thinking about new product strategies and my opinion on the markets/products for the future. I wanted to share this knowledge with my readers - that’s the motive behind this newsletter.

This article covers a breakdown of Cruise, the opportunities it has on its hands and the challenges it faces in scaling. It’s something that I’ve not seen an extensive analysis on and I’ve tried to do my best to holistically understand the company.

Grateful to Erik Torenberg for motivating me and Aarush for proof-reading it.

If you are interested in receiving future content from me directly in your inbox, consider subscribing 👇.

Join the fun on Twitter.

In the last few years, I’ve really missed having the “Woah! This is magic!” reaction when using a new product. It happened with the iPhone, VR glasses, maybe ChatGPT. I miss that feeling. But last week, I rode in a Cruise AV for the first time. I went bonkers. No words! I immediately video called my parents and 13 year old brother to show them the magic. What has probably seemed inevitable for so long was jaw-dropping. The skill and deftness with which it manoeuvred through winding roads and managed the odd jaywalker was near perfect. Plus, Cruise giving its cars cute names is adorable.

This got me thinking about the AV industry, its play-in with Uber/Lyft/DoorDash, and how this all plays out.

Intro

In 2022, Americans witnessed a substantial surge in their driving habits, covering an enormous 3.17 trillion miles up 1% compared to the 3.14 trillion they travelled in 2021. Traffic fatalities stood at an estimated 42,795 in 2022 - second highest after 2021 in the last fifteen years. While America travelled a lot in 2021, 24% of travel was between 1-3 miles and an enormous 52% was under 3 miles.

Ridesharing and last mile delivery is taking the world by storm with Uber reporting 72% growth in Q1 2023 compared to Q1 last year. 30% of shoppers expect stores to have same-day delivery. The global autonomous vehicle usage market is valued at $2 trillion by about 2030 with $100 billion being attributed to last mile delivery growing at a 25% compounded annual rate and the rest from ridesharing services. Dan Ammann, former CEO of Cruise, however values autonomous ride-hailing services to compete against current companies such as Uber and Lyft at a potentially $5 trillion sector; $2 trillion for freight; and $500 billion each for data insights and in-vehicle experiences. Indeed, with greater infrastructure development and network effects, this may be well true.

All of this creates a huge opportunity for Cruise to provide for the great market forming in the transportation sector with its fleet of autonomous vehicles. Cruise has been testing and partially operating its ride-hailing services in San Francisco and Austin while having already signed with Doordash to test last mile delivery. At the same time, with owning the end to end experience and no intermediaries to pay out such as drivers or delivery workers, Cruise aims to use its unit economics to win the gig economy and wipe out the notion of car ownership in dense cities.

About Kyle and Dan

Cruise was founded by Kyle Vogt and Dan Kan in 2013. Kyle is a serial entrepreneur who helped Justin Kan build Twitch, which he joined as an MIT dropout. Dan Kan is Justin’s younger brother—he also worked on Twitch, where he met Kyle.

Kyle’s history indicates a technical genius, with him having participated in a 2004 DARPA challenge (said to be a breeding ground for future AV technologists), interning with Roomba maker iRobot, and competing in two seasons of BattleBots.

Autonomous driving—a long standing childhood dream of Kyle’s—turns out to be a solution to one of the biggest problems in the world - mobility. Solving problems for ride-sharing and delivery, Cruise aims to provide faster and cheaper transportation (claiming to save $5000 for every San Franciscan every year) along with reducing over-population of cars on our roads.

What is Cruise’s Product?

Cruise originally planned to provide a semi/full autopilot package to complement human driving experience in cars back in 2013. However, a year into development, they shifted their focus to creating a complete autonomous driving package.

In 2016, car-maker GM bought a majority stake of 60% in Cruise for an undisclosed amount between $580 million and $1 billion, and upped this stake to about 80% in 2022 after acquiring Softbank’s stake in the startup. The deal benefits GM’s quest to build a personal autonomous vehicle and affords Cruise the infrastructure to build production level vehicles at scale.

Currently, Cruise has been heavily testing its autonomous package and has started commercial operations with GM-owned Chevy Bolts in San Francisco. The retro cars are fitted with Cruise’s AV technology to map traffic information-rich cities that strengthen Cruise’s learning systems. These proxy rides, however, serve as a precursor to the company’s final product - the Origin.

Cruise’s Origin is an ultra cost, space and energy efficient robotaxi designed to beat the costs of even a smart car like the Cruise Bolt EV by 60-70% per mile. It is also meant to have an average lifetime value 6-7 times to that of a normal car. Along with this, Cruise will borrow from GM’s large scale production expertise to build the Origin at half the cost of what an electric SUV cost in 2020—maybe around 1/4th of the current price. The Origin also has a smart storage system and customer authentication inbuilt, signalling their entry into the last mile delivery sector.

For the most part of the last decade, I would receive updates of Waymo and Cruise testing driverless cars only to know they’re private and did not plan to launch anytime soon. It frustrated me to think these technologies were years away. However, this exactly has been the AV industry’s challenge to put a vehicle on the road. Loads of data, constant learning, and continuous feedback are needed to predict the far end of long tail event distributions, with considerations for differing city layouts, random events (such as a jaywalking or an illegal U-Turn), and most importantly, avoiding accidents.

When entering a new market, Cruise first deploys a fleet of test cars with human safety drivers to map out areas. Using the mapping data, Cruise tests and evaluates the readiness of its autonomous fleet against the area the company wants its robots to operate.

Cruise also has an invite-only ride-sharing app for its beta users and is pretty simple to use. Piloting in Austin, San Francisco and Phoenix, the app limits public usage from 8/10pm to 5am, and to certain parts of the city to possibly perfect the user journey (quite literally) while also being regulated by the government in certain states.

Market

Naturally, Cruise’s ideal customer would include anyone looking for transportation in and around a city but its true disruption would come from replacing car ownership. The average new car price is at an all time high—peaking around $48,000—while an average small sedan is said to be around half that cost.

According to AAA, the average cost of owning and driving a sedan in the US is $9,364 (for 15,000 miles), broken into six categories below:

Payments / depreciation ($3,996)

Fuel costs ($1,169)

Interest ($632)

Insurance ($1,402)

Maintenance and repairs ($1,564)

Registration and taxes ($603)

Adding parking costs, traffic tickets and opportunity costs as borrowed from this breakdown, the annual cost amounts to $13,250.

cost_cruise_year = (miles_year / average_commute_distance * 5) + (miles_year * 0.9) + (miles_year / average_commute_distance * average_commute_time * 0.4)For a Cruise to be cheaper than the annual cost of owning a car (ignoring the purchase cost), the breakeven point stands at around 1600 miles—meaning that users must ride 1600 miles for it to be cheaper than owning a car. However, Cruise has barely started production, and at scale, both the flat fee and variable costs would go down. While the 1600 - 2000 mileage point in a Cruise is economical compared to a car for the <3 miles trip Americans take, Cruise definitely would look to 3-4x that mileage to start killing ownership in packed cities. Cruise would also enjoy flexibility in price-cutting compared to the average ride-sharing company considering they don’t have to attribute any margin to an intermediary human driver.

Cruise has also started looking into the delivery market through its partnerships with Walmart and DoorDash. Customers who might not have the time or resources to travel to stores or perform errands themselves would be catered to quite easily. Urbanites who lead busy lives and companies that need delivery frequently make up Cruise’s main target market in this sector.

Market Size

Cruise’s primary money maker will be the ridesharing marketplace. A graphic from Uber’s 2022 Investor Day presentation valued ridesharing penetration to be a meagre 3.9% in the US (in 2019) demonstrating the still massive addressable market that AV companies can look to chase. Currently, data and statistics aggregator Zippia predicts monthly penetration to be around 25% for 2023 which indicates the market has a lot of addressable space. Q1 2023 showed both Uber and Lyft reporting rideshare revenue growth of 72% and 14% versus Q1 2022 which can signal that the market is still responding to the lull of the pandemic partially and ridesharing hasn’t quite hit full stride yet. (Note: 72% growth is an impressive metric compared to growth rates during the pandemic and the 14% growth got Lyft to its first billion dollar quarter).

Though it doesn’t seem to be pushing as hard on the delivery front, Cruise has a sizeable market there too. The autonomous last-mile delivery market was valued at $1.1 billion in 2022, with one estimate projecting its value to reach $5.9 billion by 2030 (representing a 23.5% CAGR).

Traction

Since its founding, Cruise has grown significantly through its emphasis on creating autonomous delivery vehicles and establishing rapid iterating loops for customer ride-share journeys and business alliances with significant retailers. CEO Kyle Vogt says the robotaxi fleet is safely completing 10,000 driverless rides per week and growing 49% per month.

Apart from being backed by premier car manufacturer, GM, Cruise has gotten a major $2.75 billion investment from Honda. They’ve also bagged an investment from retailer Walmart with whom they’re piloting deliveries in Phoenix. Last year, Cruise also won the first permit to carry paying customers in a passenger autonomous car.

Key Opportunites

Replacing Human Cost

Human ridesharing businesses such as those run by Uber have become a huge stakeholder in how we commute and view transportation in future cities. Uber, for example, is a large global business worth $95B. In FY 2022, Uber reported $30.7B in gross bookings but only $8.6B in revenue. The other $20B+ went to drivers. It charges approximately $16 - $35 (depending on the level of service and the city) for a typical 7-mile trip ($2.25 - $5.00 per mile). The driver gets $12 on the $16 plus a tip (about 75%), with some of this payment covering the cost of the driver's vehicle.

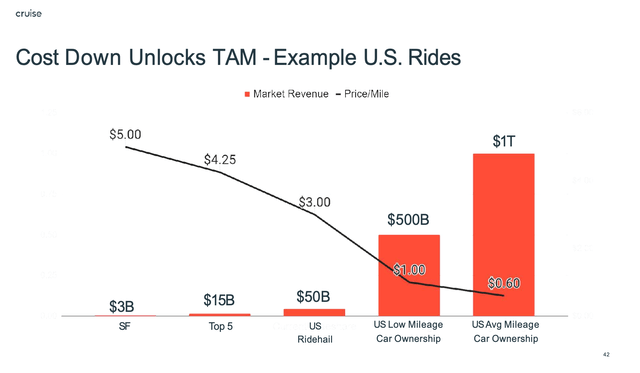

Autonomous vehicles allow Cruise to make money by eliminating the cost of drivers. It could make most of that 75% since there are no drivers to pay. An artefact from Uber’s Investor day in 2022 shows a cost per mile reduction to $1, which is feasible with autonomous vehicles, could increase its market opportunity by 25x to more than $1 trillion in the US alone.

Cruise has a steadfast advantage since it owns the complete vertical chain from production to distribution. The only factor holding it back from reducing costs right now is scale. If Cruise can find faster ways to map cities, produce and distribute cars with higher economies of scale, it would definitely enjoy a first-mover advantage for cheaper rides.

This would also directly boost their partnerships with businesses that want fast and cheap last mile delivery.

Categorical Expansion

Cruise’s primary focus has been ride-hailing and delivery markets but it could soon start looking in other tangential directions. Long haul supply chain operations could see a broad range of potential effects, impacting everything from jobs to safety and pricing. Logistic companies, already suffering labor shortage, could adopt AV technology faster than we think. While a couple of big names (like Embark Trucks) in the autonomous trucking space had to shut down due to lack of financial backing of pre-revenue earners in the bear market post-pandemic, Cruise enjoys the backing of GM and have reached a much more advanced stage in their autonomous capabilities. Avenues like city buses, airport vehicles and partnerships with a variety of delivery focused companies can be key to growing horizontally.

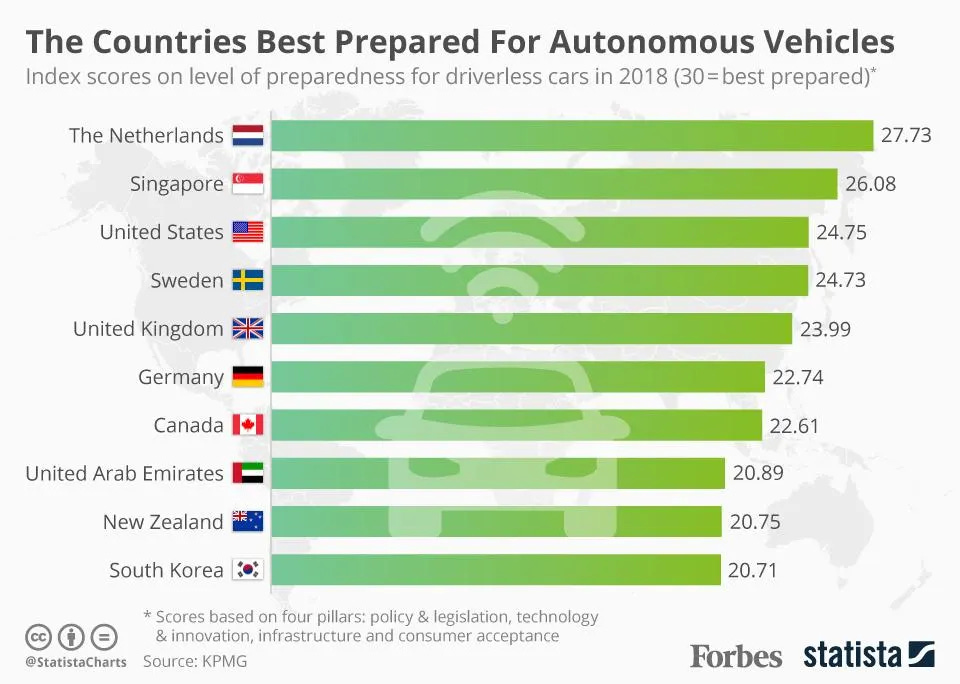

Further, technologically savvy and mature markets like Dubai in the United Arab Emirates, Singapore or Japan can become strong hold points for Cruise as these cites continue to focus on strong and cheap transport means to be leaders in tourism and commercial attractions.

However, the first steps to hyper-scaling and expanding would be to obtain permits to driving in existing cities 24/7 and managing low number fleet sizes. It is not just solving lots of unknown edge cases so that your autonomous driving can be safe and reliable enough but it is also building the infrastructure to support ride-hailing at scale as well as navigating the different AV regulations from local and state entities.

Safety and Positive Sentiment

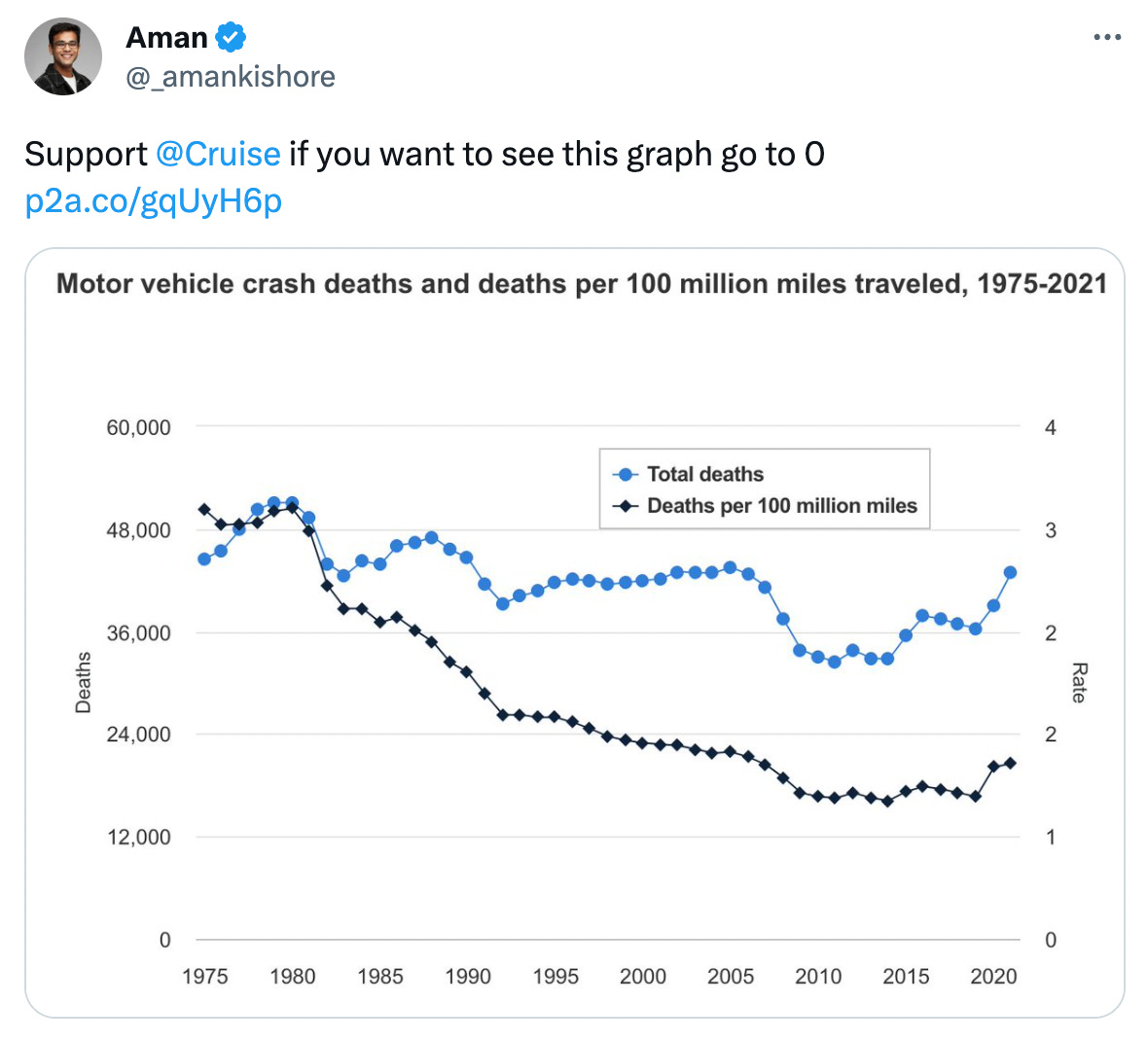

Cruise’s positive social impact can be quite substantial in making governments and users welcome to the new experience. Road accidents in the US are at record highs and this is quite problematic.

In 2022, nearly 42,000+ people were killed in car crashes in the US.

This represented a 22% percent increase in traffic-related deaths since 2019.

This April, Cruise completed its first million driverless miles which recorded 54% fewer collisions overall compared to human drivers - a huge part of their product since Cruise is not just trying to sell autonomous driving but a more advanced and safer driving experience which becomes important to have regulators and governments around the world support them. Here is an example of Cruise campaigning to make AVs a bigger part of living communities.

Driverless cars have the potential to enhance accessibility for non-drivers, such as the elderly, individuals with disabilities, and possibly even children, granting them greater independence in their daily commutes. Additionally, the improved safety on the roads due to autonomous vehicles would lead to a significant reduction in accident-related injuries. According to Compact, a mere 1% decrease in road safety incidents in the United States alone could result in an annual cost reduction of over $8 billion, presenting substantial benefits for various stakeholders, including the vehicle users.

Key Challenges

Scalability

Cruise CEO Kyle Vogt aims to have the ride-hailing company generate a billion dollars in revenue by 2025. Considering the beginning of 2023 taken as a start point, Cruise would have to make about $2.75 million dollars a day. Cruise has reported to have about 300 vehicles in its fleet right now and while an average Uber driver seems to complete about 20-25 rides each day, let’s average Cruise to start off with 15-17 trips for each vehicle. With an estimated $10 as cost for a 1.5 mile trip, Cruise would need near 18,000 vehicles to achieve its goal. Doubling the amount of rides each day would need 9,000 vehicles basically indicating that Cruise would need to scale its size of fleets significantly. The Origin vehicle costing Cruise $50,000 to produce would cost them $4.5 billion which spread over two years would amount to $2.25 billion per annum.

However, GM is already spending $2 billion on Cruise each year and would have to achieve extremely high economies of scale to make it a financially sensible venture to reach their set goal.

In the long run, it also acts as a challenge to spread to vastly variant driving conditions. While Cruise may have strong systems in place to adapt to similar driving conditions found in most US cities, spreading to a different country such as India or China would require setting up everything from manufacturing to mapping of road conditions as compared to human centric ride-hailing apps where a simple cookie-cutter model can be replicated with drivers navigating local conditions best known to them.

Another challenge Cruise will have to tend to is the unreliability of its vehicles. Though they’ve come a long way from clunky and unsafe auto rides, Cruise rides still take convoluted routes and lengthy times to reach their destination.

On the bright side, Cruise has been rapidly expanding to new cities and cutting down time taken to complete an additional million miles 100% faster than the previous million.

Distribution and Competition

While Cruise may have gone through quite a few hurdles to setup a growing fleet, challenging Uber can be quite tough. Uber may not have its own cars but being one of Google Ventures’ earliest and biggest investments, they can always rely on Google’s self driving arm - Waymo. Uber has already signed a multi year deal with Waymo to expand their autonomous driving options and a ten year deal with Motional(Hyundai and Aptiv’s AV child). This would create similar savings for Uber (like Cruise would enjoy) and if Uber enters these deals with a 60-40 or 50-50 split (on each ride), they’d be making a 25% up on their current margin, straightaway catapulting them to profitability. The $20B+ they paid to drivers gets saved with a fully autonomous fleet while self driving companies other than Cruise get to enjoy Uber’s algorithmic and market know-how as an outlet for their deep-tech. Further, Uber’s network effects with exclusive restaurant and grocery partnerships through Uber Eats, loyalty programs like Uber One and a variety of localised options such as UberAuto in India or UberMoto in Brazil makes the switchover hard to commit to.

At the same time, Cruise would seem to gun for the quality over quantity race since it definitely has a head start on Uber in the autonomous race. If not expand globally as easily as Uber can, it can use its head start to optimise cost for the end user and aim to win high market share in fewer markets rather than focus on global spread.

Summary

Autonomous delivery is a growing market with the potential to disrupt the ride-hailing space. Cruise focuses on developing self-driving vehicles to address the transportation market, the labour costs associated with it and the safety/environmental concerns. The company has started a strong loop of testing, validating and commercially running their vehicles while having secured partnerships for delivery options with top players like Walmart and Doordash. The issue in this space, however, comes from scaling easily without intensive capital or technological investment. The competition with Uber and other ride hailing companies is a factor that will play into their growth or lack of it. As Cruise enters its hyper growth stage to reach a billion dollars in revenue, they should focus on perfecting the driver experience, cutting down production costs and adopting as close of a cookie-cutter model they can to multiply fleets and cities they’re active in.

If you have any feedback or suggestion, do loop it in the comments section. I’ll be sure to take a look at it and even reach out to discuss if possible. You can reach me at avirathtibrewala@gmail.com for any other queries or discussions.

Great writing! We will likely see Cruise and other AV ridehailing become more prevelant. However, I see a few issues:

1. Many rural and suburban Americans use their vehicles far too heavily for Cruise et al to make economic sense - especially after factoring convenience costs. After all, you can just drive your car instead of waiting for a service.

2. Political valence: This is more America centric but lately every technology (except perhaps AI) gets a political valence which makes roughly half the people opposed to it. Given that cars are such a big part of identity for so many, I would think this would probably happen for AVs too.

3. Cannot replace mass transit: Car ownership in cities can already be displaced by reliable, efficient mass transit like heavy rail. NYC, Europe, and Tokyo have achieved this. This is not to say AVs cannot do the same but mass transit will be a far more sustainable vision of the future and I think we should not lose sight of that.

I believe your point that AVs are magical and loved the analysis but am deeply curious about the potential to revolutionize freight. The use case seems less vulnerable to political polarization and the space is dominated by bigger actors, making the transition potentially easier.