Hey everyone 👋 — I’m Avirath. I learn a lot from reading S1 teardowns, company analysis reviews, IPO previews and more. I wanted to share this knowledge with my readers - that’s the motive behind this newsletter.

This article covers a close breakdown of the elements of new age instant commerce startups like GoPuff, getir, JOKR, Gorillas and more. These startups have raised a lot of venture money in the past two years but whether or not their model will sustain in the long run is an interesting prospect to track.

If you are interested in receiving future content from me directly in your inbox, consider subscribing 👇.

Join the fun on Twitter

Earlier, it was a week of delivery time. Then, it was three to four days. Then, it became two days. Now, the industry standard sits at a day. Enter GoPuff, JOKR, Gorillas and getir who get you essentials in fifteen to twenty minutes. FIFTEEN TO TWENTY MINUTES.

These hyper fast delivery apps have taken the world by storm and their instant delivery surely impresses but there’s a lot going behind the scenes. Most of these companies aim to break the traditional marketplace model of how online grocery delivery processes of the typical Instacart/Shipt model works these days.

Outlook into the space:

The instant delivery grocery model has made a lot of noise in 2021 with numerous startups over the world getting into the space with venture backed money and aiming to take market leadership in the space. In the bustling city of New York alone, there are four companies that also happen to be the biggest players in this field:

GoPuff(raised over $3.4B)

JOKR(raised over $170M)

Gorillas(raised over $1B)

Buyk(raised over $46M)

Companies like JOKR only became active in April of this year while Gorillas and Buyk are also relatively young ventures. At the same time, a lot of high profile investors like Tiger, Sequoia Capital, Greycroft Partners and Softbank have come calling on the doors of these startups in various investment capacities.

Instant Delivery Model vs Current Marketplace Model:

The current marketplace model operated by companies like Instacart was a revolution in its early days as it powered the gig economy and brought convenience online. In the typical online grocery model, a user(say John Appleseed) logs onto Instacart, chooses the store(such as Publix or Krogers) they’d like to buy from and then place their respective order. Once the user places their order, the order is routed to a gig-worker who goes to the particular store the order is placed at and shops the items as you would if you were in their place. The gig worker then delivers the items to your doorstep. This, in totality, can take 30 minutes to two hours depending on the number of free gig-workers in a certain range according to your location, how busy the store is at that point of time, whether or not your order needs replacements and/or cancellations.

New age instant delivery startups aim to optimise the entirety of this process by vertically integrating. They do so in several parts and stages:

A. Dark stores(Micro-fulfillment centres)

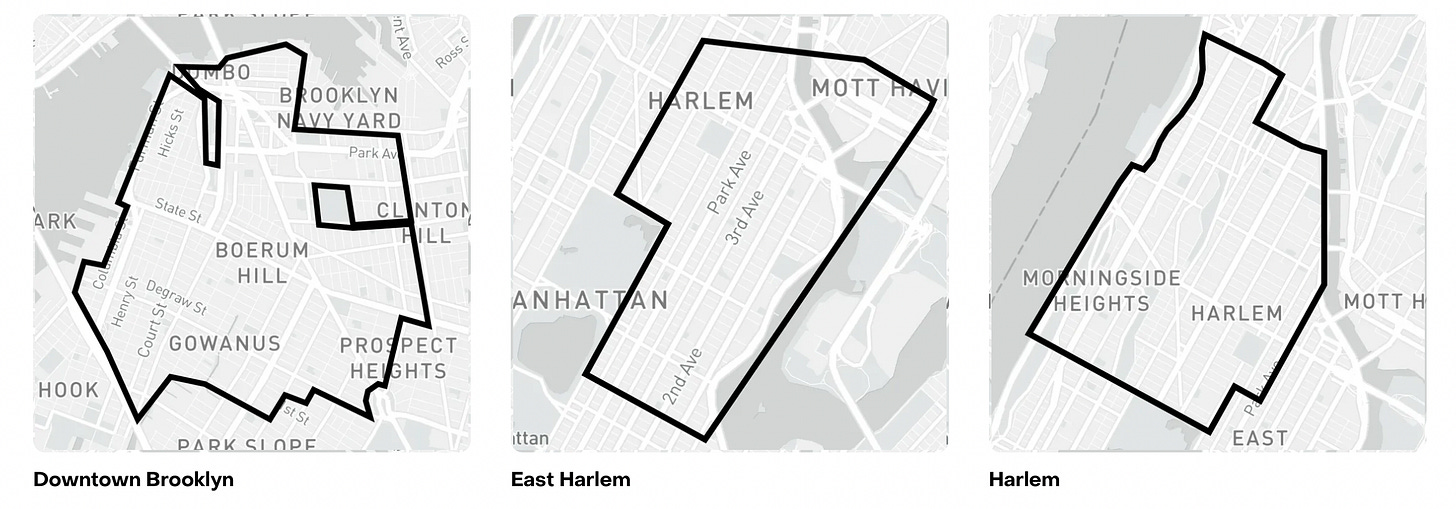

The biggest source of optimisation in instant delivery startups comes from operating no retail stores and only fulfillment centers that process a customers orders only for delivery. These dark stores play an important role in the economics of the instant delivery model. These dark stores tend to be automated and their entire spacing, shelving tends to be designed to make it fast to fulfil any item. Further, these microfulfillment centres cost about $2-5 million depending on whether the land that they set the centers on are leased or brought. On the same note, huge warehouses like the ones operated by Walmart or Amazon can easily cost a solid $30-50 million. Retail grocery stores run by Publix, Target or Krogers can easily cost about $20-30 million. The extremely low costs lets dark stores be set up optimally for smaller locations rather than one large warehouse processing orders for a lot of cities or districts. To explain, here are the set of areas that Gorillas delivers to in New York currently. As seen by the demarcated regions, Gorillas probably operates different centres for East Harlem and Harlem which is only around 10 mins by drive. This goes to show the distribution of centres which forms the basis of quick delivery for these companies. The math adds up to since the low cost at about $2-5 million lets GoPuff or JOKR open multiple fulfilment centres for smaller regions enabling quick delivery. GoPuff runs about 500 fulfillment centres already.

B. Limited SKUs

A very important concept that instant delivery startups power is having limited SKUs that allies with the concept of multiple fulfillment centres. A normal warehouse that Amazon or Walmart operate carries around 30,000 SKUs but grocery stores carry around 15,000 SKUs. Instant delivery model startups operate only 3000-5000 SKUs which help in maintenance of these micro-fulfilment centres. In micro-fulfillment centres, companies can’t afford to have items with long shelf lives that have low churn rates. Since space for items is limited, items are needed to be moved faster to meet the price justification of having less items. Further, if you’ve noticed as a user, GoPuff or Gorillas doesn't let you shop an entire grocery list consisting of fruits, vegetables and wet foods. It usually promotes and sells snacks/instant needs/dry items the best. The reason can again be traced back to limited SKU quantity. Quick perishable items like fruits can cause wastage at the backend if they aren’t popular items - this causes not only money loss but also occupies space in whose space you could have items that would’ve churned faster.

Something that comes as a threat or challenge with limited SKUs is the ability to grow into more industries with longer shelf life items. For example, a clothing brand can possibly have 12-15 SKUs for just a single T-shirt of different colours and sizes. This leads to the question as to whether these companies will be ever able to expand outside instant need items and be profitable.

C. Employees

Marketplace apps like Doordash and Instacart changed the way employees were structured. It promoted the rise of the gig-economy where Doordash riders or Instacart riders weren't employed by these companies. However, these new age delivery companies have chosen to reverse the process. They choose to have two sets of distinct employee groups - a set of pickers within the warehouse who are placed within micro-fulfillment centres to pick specific items within an order. On picking these items, they’re handed over to riders who deliver orders.

Economics of all of this

For a long time, brick and mortar stores have had success with dominating how grocery worked. Before the rise of mobile phones and the Internet, people had to plan grocery meals in advance and then make long trips to cheap grocery solutions(ex : Costco). However, this solution worked for most people. It only worked because it seemed like there was no other way to optimise this process. There are a lot of underlying problems associated with the way grocery is/was structured like this like money spent on fuel, time spent on constant trips to brick and mortar stores, energy required to do this on a weekly/bi-weekly basis. Enter the Internet and smartphones.

With the advent and rise of the net and smartphones, a three party marketplace was getting established. These three party marketplaces connected customers, couriers(gig-workers mostly) and supermarkets. In this model, customers ordered for grocery from their apps like Instacart, someone(a gig worker) picked the grocery for them and had it delivery right outside their doorstep. It’s basically as if you are substituting your trip to the grocery store to someone else and this also meant that you didn't have to plan for meals days/weeks in advance and could have grocery out your door in 45 minutes to an hour.

However, as this model scaled, problems started creeping out one of which was the inefficiency with having a middle layer taking a cut that led to slimmer profit margins. The marketplace model also started showing problems with not being able to keep up the ratio in terms of couriers to customer orders which leads to huge delays at times.

Then, COVID hit. All of these problems exacerbated. Delivery times shot up. Sometimes, there weren’t enough couriers to facilitate deliveries. All of this led to the birth of the newest e-grocery solution - instant delivery. GoPuff set the model for instant commerce and herds followed. GoPuff has shown to be EBITDA positive since day one defying investor expectations of this only being a money-losing business. They’ve proven that their model works in population dense regions like college towns as well. As a college student, I’ve never had my GoPuff order take more than 25 minutes at the most with the average being 15-20 minutes.

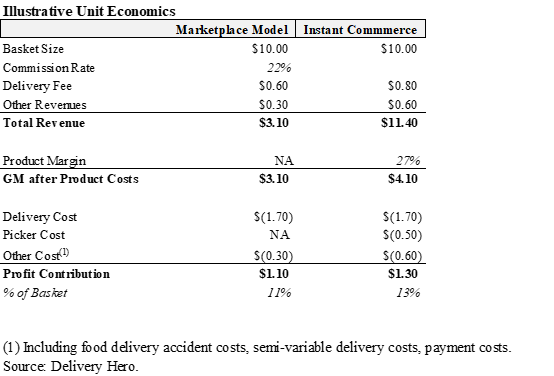

Delivery Hero, a group of several food delivery companies located around the world, reports the following economics for instant commerce versus the marketplace model reporting a hunger profit margin from the instant commerce. Though one article doesn’t form the basis for an entire industry, it seems promising and must be paid heed to.

Conclusion

To put it simply, the instant commerce model isn’t perfect. There are a lot of metaphoric weeds that have to be ironed out. There is no proven model that shows that instant commerce can function perfectly without venture money. Marketplace models like Instacart have made a lot of strategic acquisitions and brought in some key advisors to branch their future ahead(it won’t be easy to topple over such giants). At the end of the day, with so many startups crowding the space, only a few may sustain who lead the market while the others may get wiped out.

The biggest problem with this model that I find is the establishment of instant commerce as a substitute to marketplace grocery. In my personal opinion, I haven’t found models like the one GoPuff runs able to take over complete grocery solutions with the ability to deliver perishable items such as fruits. The requirement for fast moving shelf life products that don’t go waste can make it hard for this model to sustain in the long run.

If you have any feedback or suggestions, do loop it in the comments section. I’ll be sure to take a look at it and even reach out to discuss if possible. You can reach me at avirathtibrewala@gmail.com for any other queries or discussions.