Hey everyone 👋 — I’m Avirath. I learn a lot from analysing new products, thinking about new product strategies and my opinion on the markets/products for the future. I wanted to share this knowledge with my readers - that’s the motive behind this newsletter.

This article covers India in 7 graphs, the areas it’s excelling in and places where it can improve. It’s a bit different to what I usually do but I wanted to learn about basic socio-economics and macro markets. It also celebrates India’s landing on the moon! This article did take longer than the two-week schedule I have but that’s because I got back to school after 8 months and have been settling in. I’ll be back on schedule with the next post!

Grateful to Erik Torenberg for motivating me and Aarush and Divi for helping edit it.

Go to the end of the post for a surprise!

1️⃣ UPI eating away Debit and Credit card transactions

The biggest success story to come out of India’s digital age is not a company but the Indian Government spearheaded real-time payments network - Unified Payments Interface. To put in simple words, the Unified Payments Interface is a set of APIs(i.e., a software middleman) that provides two services — pay (push), and collect (pull).

Every customer making or receiving a UPI payment interacts with three key entities — the UPI application on their phones, the Payment Service Provider (PSP) and their Bank.

UPI applications are the front end mobile apps users use to start a transaction — like PhonePe and Google Pay. PSPs handle authentication for the user and connectivity with the bank and UPI backend. The responsibility for actually debiting the payment and crediting the beneficiary rests with the banks who manage the customer's accounts.

UPI transactions can be done with unique identifiers like phone numbers also known as Virtual Payment Addresses(VPAs). VPAs look something like — username@psp-handle (e.g. leo@icicibank), where psp-handle is a UPI specified handle for the participating bank. The VPA maps to your bank account using the username and registered phone-number.

Let’s break down the anatomy of a payment to a food delivery marketplace like Uber Eats.

The recipient's Virtual Payment Address (VPA), payer's account details, and transaction specifics are securely transmitted from the user's device to the Payment Service Provider's (PSP) server.

The PSP forwards this information to the user's bank.

Using the recipient's VPA to account number mapping, the PSP responds with the merchant's (Uber Eats) account details.

Through the Unified Payments Interface (UPI), the payer's bank receives the payer's account information and is requested to deduct the payment amount.

After debiting the payer's account, the bank informs UPI of the successful transaction.

UPI then instructs the merchant's bank (beneficiary bank) to credit the merchant's account.

Upon successfully crediting the merchant's account, the beneficiary bank notifies UPI.

UPI confirms the payment success to the payer's PSP.

The user receives a notification on their device, indicating that the payment has been successfully processed.

In July 2023 alone, UPI processed transactions worth 15 trillion rupees with a volume of 9 thousand million transactions.

To understand the benefit of UPI, one has to understand how India does business. India’s most popular type of retail store is a kirana( better known as mom and pop stores ) and the country boasts a network of 13 million such stores that cover 90% of India’s 600 billion rupee food and grocery retail market. These stores have an average monthly turnover of barely 0.2-0.75 million rupees and probably take home a 10-15% margin. Regulatory frameworks have made sure that UPI payments remain transaction cost free in most cases supporting small merchants. Further, since POS systems or accounting cash registers are expensive to buy and maintain, merchants prefer to deal in cash. However, this creates a lot of trouble maintaining accounting ledgers and records which in turn leads to poorly maintained accounts for these stores. Consequently, the combination of lack of collateral otherwise and poorly maintained accounts leads to banks turning such store-owners down for credit funding or loans.

With UPI, merchants of all sizes from Kirana stores to international grocery marts, simply need to stick a QR code on their checkout desks. In addition to accepting payments easily, UPI powered applications like PayTM have built backend ledger book support for stores to track cash flows and accounts. A glance into the cash flows of such businesses opens the possibilities of lending to such stores on the basis of revenue, profit margins and cash flows. With the creation of the Open Credit Enablement Network, data of specific merchants can be shared with banks and other lending institutions who can provide competitive interest products. At last count, 30 million-plus merchants are using QR codes, according to data from consulting firm BCG. Mind you, there are only 6 million point-of-sale (POS) machines for swiping credit and debit cards, despite decades of presence.

Another interesting point to note is that UPI is interoperable, in the sense, that any UPI powered app like GooglePay or PayTM can be used to pay to any UPI backed merchant app. With this leading to commoditisation of payment apps, companies have come out with interesting ways of monetisation such as a cheap speaker box POS system that prevents fraud by saying out loud a success message every time a payment is processed. Earlier, people would dupe merchants by showing them fake payment success screens and in the haste of business, merchants would miss out on few transactions.

PayTM and PhonePe have already sold 6.8 million and 2.2 million units of these devices respectively. PayTM claimed that its Soundboxes processed 5 billion transactions in FY22, accounting for 38% of the company’s net payment revenue. The company made $150 million from Soundbox subscriptions in the third quarter of this financial year.

2️⃣ Rails and Roads

Long notorious for its endless, noisy train rides, congested roads, and shoddy airports, the nation is undergoing an unprecedented mobilisation makeover unparalleled outside of China.

Since Hon’ble Prime Minister Narendra Modi took office for his first term in March 2014, construction of National Highways has increased from 91,287 km in March 2014 to about 1,45,155 km at present. The Modi Government also undertook the Vande Bharat Express railway mission to provide short-distance and fast connection between major cities under a day. The new train sets are supposed to reduce time taken to travel between destinations by 15% compared to the previous Shatabdi set of trains.

Agglomeration effects of infrastructure development are easy to understand. Infrastructure development decreases transportation costs for goods and people, improves access to markets, and plugs people to a wider array of jobs and societies. These effects are a powerful reason that cities exist, and that economic activity clusters in certain countries. Add in clustering effects — the tendency of companies in the same industry to locate nearby to each other — the effect becomes even stronger. An example of the promotion of this phenomenon would be the creation of GIFT( Gujarat International Finance Tec-City ) along India’s western coast to promote finance and tech companies to setup headquarters with special economic zone benefits.

One of the downsides, however, of this manufacturing push is that our exports haven’t manufacturers in India seem to be constrained in their ambitions. As a product exporting country, most of India’s exports are natural resources, agricultural products and hints of electronics and labour intensive goods.

Natural chemical products tend to be capital intensive and usually make the rich richer. Garments and electronics usually help in moving poor people from farms to industrialisation. Garments, in fact, marked the start of the Industrial Age in Britain and has helped Bangladesh reach higher levels of urbanisation faster than India.

Another point to consider is that PM Modi’s “Make In India” campaign while deregulating and subsidising manufacturing, could only stir production for within India. The thing is India has such a huge domestic market and because of that manufacturers are very comfortable producing only for the local surroundings. This kills productivity and manufacturing upgrades for serving foreign exports. For instance, South Korea recently hit all time highs for car exports and serve the foreign mid-sized automobile market really well. The government must change its policy to “Make in India for the World” incentivising exports rather than just production.

We are witnessing a change in that behaviour with Apple and other tech companies having started production in India for the world. In 2021, India accounted for 1% of iPhone’s world production, increasing to 7% in 2023. Apple aims to move over 25% production capacity by 2025. With production costs no more low and trade/political relationships with China at arguably their worst, India becomes the next obvious alternative to look at. Noah Smith argues that there’s a psychological barrier where executives and managers are very used to putting factories in China, and very unused to the idea that they could put factories in India. But, if the world’s most valuable company can trust Indian supply chains and manufacturing, who is anyone else to argue 🤓?

3️⃣ Escaping Poverty

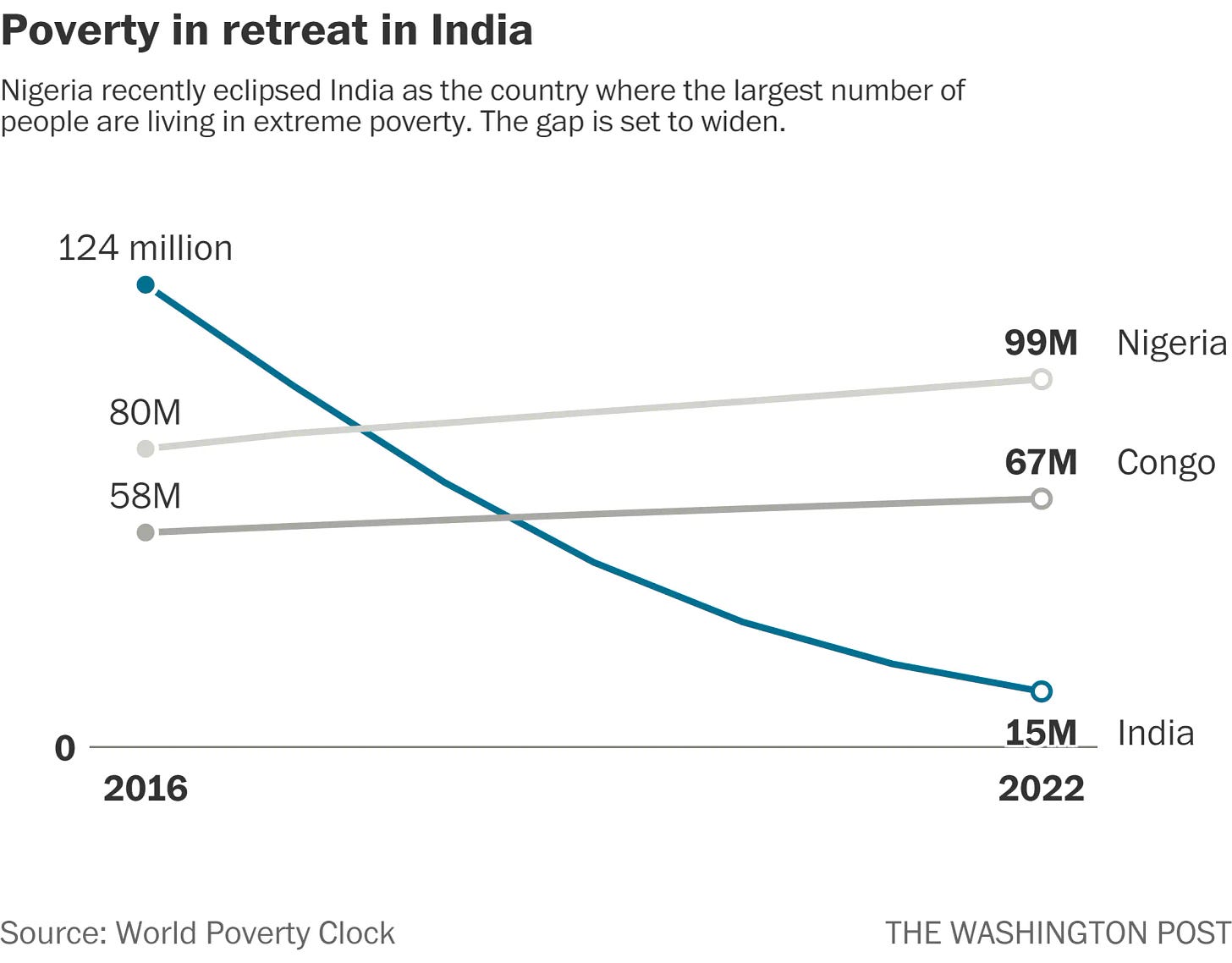

One of the most influential consequences of the financial and infrastructural development is that India has made giant strides in lifting people out of poverty. The World Poverty Clock predicted that India would knock out complete poverty by 2018 but with COVID those predictions are probably a bit delayed.

Under the Gram Swaraj Abhiyan, 60,000+ large villages with very high population of the deprived communities were provided seven services: cooking gas, electricity, LED Bulbs, immunisation, bank account, life and accident Insurance).

Over the last two decades, India as built or redeveloped over 600,00km of rural road in an effort to accelerate rural road connectivity, bridging the connectivity deficit.

Lack of inclusion via identity cards or financial documents would restrict people in rural areas and those in poverty from getting access to services and utilities such as gas, financial support, drinking water and electricity. To solve this, the government has enacted a trifecta of reforms: AADHAR, Jan Dhan Yojana and Mobile Connections.

Aadhaar is a 12-digit individual identification number issued by the UIDAI (Unique Identification Authority of India) on behalf of the Indian Government. In India, the Aadhaar number serves as a proof of identity and address. Any citizen of India is eligible to apply for Aadhaar Card. They can receive it via India Post, and as an e-Aadhaar downloaded from the UIDAI website. It captures fingerprints, retinal scans, and facial identification as chief authentication factors for transactions maintaining total uniqueness.

In 2014, the government announced the Jan Dhan program to achieve the goal of universal financial inclusion where they began to link Aadhar IDs with backed bank accounts. This, further, helped in implementing Aadhaar-enabled remote authentication services to verify beneficiaries at the point of service for subsidized food and fertilizers, pensions, and other benefits. Further, transferring subsidies and cash directly to beneficiary banks becomes easier with Aadhar linked accounts.

The government has also stressed on people getting mobile connections where the private sector has made a significant push to improve mobile connection access too. Indian business magnate and Reliance MD, Mukesh Ambani, launched Jio( a mobile network service provider) in 2015 with a revolutionary free one year SIM connection on verifying your identity and connecting your AADHAR to a phone number. In the years following, Jio has become the largest mobile network operator in India and the third largest mobile network operator in the world with over 42.62 crore (426.2 million) subscribers, playing a role to improve mobile connectivity to 90 subscriptions per 100 inhabitants in 2020.

Data and LTE access gives rural areas access to better resources for education and connectivity improving the overall conditions of those in poverty-stricken areas.

4️⃣ A country of contradictions: women

One of the most interesting graphs I found is a depiction of how India leads the world in number of employed female pilots yet has one of the lowest female labour force participation rates. Similarly, at the end of 2021, only a meagre 12% of women in India held credit cards. Start-ups with women-majority teams constituted less than 15 percent of all the pitches made on the recently started Shark Tank India. Further, just nine pitches came from all-women teams that belonged to a Tier-II or Tier-III city. Contradicting in nature, however, education rates for women have been steadily rising.

This puzzling statistic can owe its answer, partly, to how families are structured in India. Though reducing in number, joint families still make up about 50% of the families in India. Joint families tend to hold reserves of generational wealth and run businesses that span more than a couple of decades. Here, it is regarded as unnecessary for women to work to help the family be financially sufficient. Further, Indian families stress a lot on children growing up with adequate maternal attention and the culture of daycare/nannies is almost absent. Thus, women move in and out of professional settings dependent on their family’s needs and this creates inconsistency in the workforce.

There’s also a lot of stigma and bias involved towards giving females deep technical or leadership roles. Inconsistent work, strong familial roots where women are expected to nurse the child, low requirement to be financially independent and discrimination are the biggest hurdles to women joining the workforce.

The most direct benefit of increasing women in the workforce would be an increase in the GDP with a report in the BBC claiming a 10% increase in the number of women in the workforce would lead to an additional $550 billion added to the GDP. The second-order benefits would be more people leading their lives with agency and purpose in the country, some of whom become successful and act as role models creating a flywheel for women to breakthrough in more than just familial roles.

5️⃣ Internet Users and Marketplaces

In her poem, “In the Bazaars of Hyderabad”, Sarojini Naidu describes markets in post Independence India to be bustling with merchants, traders and magicians selling a variety of fresh fruit, well-ground spices and rich ornaments.

What do you weigh, O ye vendors?

Saffron and lentil and rice.

What do you grind, O ye maidens?

Sandalwood, henna, and spice.

What do you call , O ye pedlars?

Chessmen and ivory dice.

In 2023, these sights, sounds and smells have been replaced with the convenience, reliability and efficiency of online marketplaces. This transition can be largely credited to two ex-Amazon employees who marked the start of a defining era in Indian entrepreneurship with their iconic venture in 2007.

Sachin and Binny Bansal’s Flipkart instilled confidence in Indians that Amazon-level businesses can be pioneered in India. Quick checkout commerce, same-day delivery and superior customer service all came to India courtesy of Flipkart. Walmart buying Flipkart in 2018 validated that the country had the payment rails, supply chain infrastructure and e-commerce market to create world class digital companies in India. Post 2018, we’ve seen unicorns spring up in marketplace sectors like Nykaa( cosmetics ), Tata 1mg ( medicines ), Acko ( health insurance ), CarDekho ( car insurance ), Boat ( consumer electronics ). The variety of sectors is huge. If something can be sold, there’s a probably a marketplace for it.

Tangentially, close to two-thirds of the population has access to a smartphone, and by 2040, it will be over 95% of Indians. Indians have access to some of the cheapest mobile data plans in the world, and charges are $0.17 per gigabyte on average, with plans as low as 5 cents per gigabyte. More smartphones and cheaper Internet access means more consumers for foreign firms to target.

India’s middle class is yet to expand. 47% of Indians, about 650 million, are below the age of 25. This youth bracket has lived in an India that has averaged about 6 percent annual growth for three decades and has access to global goods and content. As they age, they’ll command higher spending capacities in a fast growing economy. Per capita and median incomes will rise for the Indian Internet age consumer. All of this leads to more creation, curation and consumption online opening opportunities for foreign firms to increase revenue share per user and domestic companies to create tailored software products.

Below is an artefact showing Facebook’s MAU and advertising revenue metrics in India compared to that in the US. Foreign consumer Internet businesses treat India as a user farm while making their monies in higher per capita economies. While foreign firms are waiting for the rise in Indian spending capacity, this presents an opportunity for India entrepreneurs to create products and strategies with only the Indian consumer in mind.

6️⃣ Education

In the previous section, I’d stated half of India’s 1.4 billion population (~650 million) are in the 5 to 24 age bracket, and over 27% of the population is under the age of 14. No country has more young people. India has over 250 million school going students, more than any other country.

However, India’s tertiary enrolment(i.e the number of students who attend college after graduating high school) is hardly 30%. For example, the India Brand Equity Foundation points out a huge demand supply gap with an additional requirement of 200,000 schools, 35,000 colleges, 700 universities and 40 million seats in vocational training centres to manage the huge student overload. India’s education expenditure(including both national and state level) amounts to about 2.9% of the total GDP, a figure that has remained constant for the last 4 years and well below the 6% outlined in the National Education Policy 2020. However, more than how much is being spent, I feel more strongly about what kind of education tax money is being spent on.

The Indian education system follows the Macaulay education system, which was generated by the British to produce clerks who could work for them without much questioning.

In his intro class to Valuation, Aswath Damodaran, brings up an example of how National Geographic filmed a herd of lemmings commit suicide by jumping off a cliff because each lemming just followed the lemming in front of them. His point was to drive that many investors just invest trying to replicate other investors or their strategies. The Indian Education system is similarly designed to create a great labour workforce - blue collar and white collar. However, not enough development is done on the research and application fronts.

The combined research output of 39 federally funded Indian universities is less than that of Stanford alone. India invests only 0.69% of GDP in research and innovation, compared to 2.8% in the US, 2.1% in China, 4.3% in Israel, and 4.2% in South Korea. From my own experience studying in India till age 18, school systems are structured around students’ passing exams and achieving the highest “marks,” rather than true learning. One of my schools displayed the top 5 mark holders in all subjects on the whiteboard.

While bringing Shark Tank to India was a brilliant start to application of science and business to real world problems, a large share of startups that came out of the Tank were in retail goods. That’s a great start but India does need to push for better software and hardware innovation.

An easy segue into this could be simply requiring public companies or deep tech companies over a certain cap size to hold yearly internship programs and hiring varying percentages(depending on size of company) of their workforce through these programs. These internships can be competitive like their US counterparts, creating a loop of students working on actionable items to get into such internships, learning from such MNCs/programs and adding creativity to the workforce and the country as a whole.

The Government also released the National Education Policy in 2020 aimed at changing the structure of education from a 10+2 structure to 5+3+3+4 structure where the student will go through primary, preparatory, middle and secondary classes of education rather than being grouped into 10 years of rote learning followed by secondary education. It also outlines a transfer of learning style to a holistic approach integrated with more application based learning.

Another partnership the Government can drive is partnerships with private ed-tech companies. Startups like Unacademy, Byjus, Toppr, and Vedantu provide decent distance learning and coaching for regular school and specialised examinations. Public colleges can tie up with such startups to provide online degrees. Companies like Sora are already providing online MBAs. Someone who I admire for creating opportunities for under-skilled professionals in the US is Austen Aldred who runs Bloom School where you don’t pay any tuition till you get a job after going through a bootcamp. Such partnerships will take time to solidify but could prove highly fruitful for those who lack infrastructure or capital to attend private schools or in areas where public school aren’t upto the mark.

Skilled education will help India move faster from agriculture to tech-backed urbanisation also incentivising countries to setup offices and offer employment.

Lastly, such efforts will reduce the massive brain-drain that India suffers where the brightest minds look to take their talents to other parts of the world for better satisfactory work and higher pay. Holistic education and job creation for the highest age demographic in India’s population will only pay off in the coming decades as India looks to become a superpower.

7️⃣ Watch this SPACE

“There are some who question the relevance of space activities in a developing nation. To us, there is no ambiguity of purpose. We do not have the fantasy of competing with the economically advanced nations in the exploration of the moon or the planets or manned space-flight. But we are convinced that if we are to play a meaningful role nationally, and in the community of nations, we must be second to none in the application of advanced technologies to the real problems of man and society.”

- Vikram Sarabhai, ‘Father of the Indian space programme' (1919-1971)

In 1962, the blue eyed boys of Indian science and research, Dr. Vikram Sarabhai and Dr. Homi Bhabha (the father of India’s nuclear programme) laid the foundation of the Indian National Committee for Space Research (INCOSPAR) under the command of PM Jawaharlal Nehru. The Indian Space Research Organisation (ISRO) was later formed on 15th August, 1969.

By that time, Neil Armstrong had apparently set foot on the moon and the USSR had launched several satellites into space. 15 years post independence, India was thrust into its space journey.

While the US and USSR participated in an expensive space race to win bragging rights, India has always maintained a policy of using its space capabilities to develop the country’s infrastructure. The Satellite Instructional Television Experiment (SITE), for example, was initiated in 1975 with the aim of testing the viability of using satellite broadcasts to educate rural populations in the remote areas of the country. This project was regarded as a significant sociological undertaking and was recognized as the world's most extensive experiment of its kind at that time.

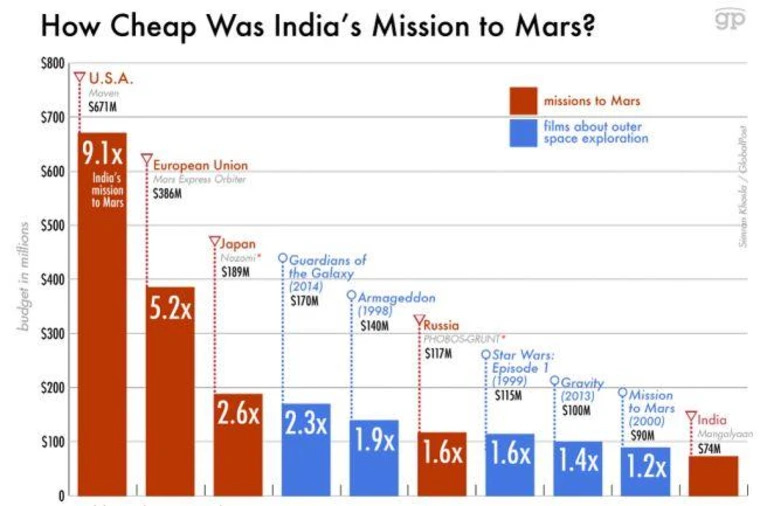

In the years since, India built its own indigenous satellite navigation system called NavIC to reduce dependence on GPS. In the last ten years, India launched a mission to explore Mars’ orbit, two missions to the Moon and was the first country to land on the South Pole of the moon where it’s confirmed presence of oxygen, silicon and other essential minerals and materials.

The benefits to meteorological, agricultural, communication and many other systems that a country depends on via satellites is just unparalleled. Arguments about India running a space programme while fighting poverty is akin to comparing apples with oranges. Rather than debating about whether India’s space mission makes sense, countries can collaborate to how India runs such economic friendly space programs which will only provide more budgetary leeway for countries to launch multiple missions.

India’s recent economical successes in achieving space travel have also opened up opportunities for a swath of private space tech companies. In various domains such as manufacturing, launch services, communication, and software development, there exists an extraordinary level of ambition. Emerging space-tech startups have articulated their mission statements in ways that reflect grand aspirations. These include intentions to create a global ‘health monitor for the planet,’ develop a ‘Google Maps for space,’ provide ‘navigation in space as a service,’ establish a ‘fleet of space taxis,’ democratize access to space, and enhance the affordability, dependability, and frequency of spaceflight. Notably, these startups are relatively young, having emerged primarily within the last ten years. Take a look at few of them here -

Skyroot: Akin to SpaceX, Skyroot is the first company to launch India’s first privately built rocket. It plans on making these launches a monthly habit from 2025. Interestingly, Skyroot plans to use reusable rockets to make this possible - something SpaceX does really well.

Agnikul: Agnikul is similar to Skyroot. Both use 3-D printed rockets to make the manufacturing process easier and cheaper. But while Skyroot is targeting the big fish, Agnikul wants to focus on taking small satellites to space.

SatSure: SatSure is a deep-tech company that analyses data coming in from satellites and translates into actionable insights. Examples include crop harvesting rate, air particulate pollution in specific cites and more. This data helps industries, agriculturalists and government bodies take well decisioned actions!

To learn more about India’s space and nuclear programme, do watch Rocket Boys!

If you have any feedback or suggestion, do loop it in the comments section. I’ll be sure to take a look at it and even reach out to discuss if possible. You can reach me at avirathtibrewala@gmail.com for any other queries or discussions.

As a part of my newsletter, I wanted to affect some moral good to the society we live in. Every time I publish a post, I’ve decided to share an artefact or excerpt on kindness and benevolence.

This week, since I am a huge Erik Torenberg fan, here’s a tweet from him shouting out everyone being a bit better today! If there’s some habit you want to be better at, you can ALWAYS start today!